Life Insurance - Success Stories

Tom is a thirty something year old married dad with two beautiful daughters. He is a hard work man with a small growing business. His wife cares for his daughters and supports his business part time. They have a home mortgage and some other debt plus a modest savings that would help with short term needs. They fit the traditional picture of a young family living on a limited budget now with a great future ahead.

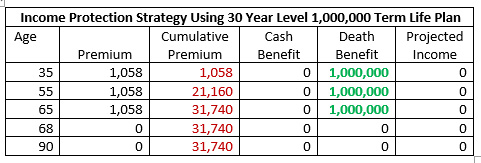

Tom is also blessed as a healthy guy and would easily qualify for life insurance. Naturally, we looked at term life insurance. At first it seemed a 30-year level plan would take him close to retirement and his girls would be fully grown and independent well before then. Protecting his family’s future should he die too young was a priority and one he could secure at a low cost.

There was no question that Tom needed to have a significant death benefit in place at this stage of his life. Tom also understood he needed to be saving for the future. Time was on his side and compounding; tax deferred compounding would be a very good friend.

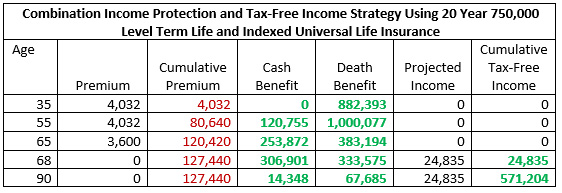

Tom decided to protect his family’s future and start saving for his future by getting both a term life policy and an Indexed Universal Life (IUL) insurance plan. The Indexed Universal Life plan provided a more moderate death benefit so we needed the death benefit of a term life along with the IUL. The IUL policy was designed to accumulate as much cash as possible that he can “borrow” from and use to supplement retirement. The way the plan was designed, the cash he ‘borrowed” would be income tax free.

When Tom turns 55 and the term life policy expires, his death benefit protection will be reduced. This was of minimal concern to him. His term life policy gave him a conversion option he could use to extend coverage if he wanted to do so. Also, if he continued to be blessed with good health, he might buy another term life plan at that time.

Tom had to find additional cash to fund the Universal Life plan. Understanding this was not his entire retirement fund, we were able to scale the IUL plan accordingly.

Also, instead of buying the 30-year term life plan, he felt comfortable scaling down to a 20-year term life plan. That reduced the premium which helped to offset cost of the IUL plan.

Tom’s family has significant income protection through the critical years, and he has a tax-free income stream waiting for him when he retires.

As illustrated, Tom’s investment of 127,440 in the IUL plan will yield him 571,204 in tax free income and provide a 67,685 death benefit should he live to age 90

Key financial highlights from the two strategies:

![]()

* Projected cash values and full death benefit values are not guaranteed. Please refer to policy illustration for details. Not a licensed tax advisor, consult your tax professional for tax related advice.

Jerry is an established business owner that decided to partner with another entrepreneur. His new partner brought a different skill set and a significant amount of cash into their business arrangement. The cash was used to buy equipment for expansion. Both Jerry and his business partner, Al, had concerns regarding business continuity should either man die. There was almost a 30-year difference in their ages. They decided to put a plan in place for business continuity should either pass. The older partner, Al, had just invested heavily in the business. If Al passed away, how would his family get value back for his investment? Would they have to take an active role in the business? How would they be made whole?

They drafted a formal agreement that described how the business would be valued and their families could be made whole for each partner’s portion of the business. The plan provided the formula for determining company value. The funding necessary was provided by separate life insurance policies they each owned on the other. By each owning the life policy on the other, they were assured the policy would be available as it was intended. The owner determines who the policy beneficiaries are.

Now the business can keep moving forward and the partners and their families interests in the business are protected should they die.

We are all different, we are in different situations and have different priorities and different resources. These examples are here to provide a general picture of the ways we help others protect their family and provide for their family over the long term. Insurance is forward looking and when applied properly, a very valuable tool.

We look forward to hearing your story and providing you with options that help you protect and prosper.